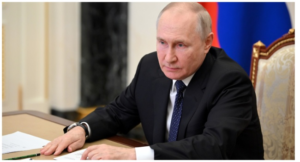

The recent coup in Niger and its embrace of Russia and President Vladimir Putin, writes David Olive, has sounded global alarms about Russia’s dominance of the global nuclear fuel supply chain.

The July 26 coup d’état in Niger could eventually spur dynamic growth in Canada’s uranium industry.

The degree of Kremlin involvement in the military ouster late last month of Niger President Mohamed Bazoum is unclear.

But pro-coup demonstrators in the streets of Niamey, the Nigerien capital, wave Russian flags to express their anti-American and anti-French sentiment. That sentiment has been stoked for years in the former French colony by Russian propaganda.

If Niger is drawn into the Kremlin’s embrace, Russia and its allies, notably the big uranium producers Kazakhstan and Uzbekistan, would control more than 60 per cent of the world’s uranium supply.

In enriched form, Niger’s output of raw uranium accounts for about 25 per cent of the fuel used in the nuclear power industry of the European Union (EU).

And Russia is the world’s sixth-largest uranium producer. But Russia’s real power derives from enriching almost half of the uranium used in the world’s more than 430 nuclear power reactors.

The U.S. nuclear power industry buys about 14 per cent of its enriched uranium from Russia.

Which explains why the West has sanctioned most Russian energy exports over Russia’s invasion of Ukraine, but not uranium.

Canada is one of the few major nuclear energy producers that is self-sufficient in uranium. Nuclear energy provides about 60 per cent of Ontario’s electricity generation.

The upheaval in Niger has turned mounting concerns about Russia’s dominance of the global nuclear fuel supply chain into outright alarm.

The EU is just as threatened by a suspension of uranium supplies by Russia and its allies as it is by oil and gas constraints. A large portion of the U.S. economy also relies on Russian enriched uranium.

In March, the U.S. Department of Energy warned that continued reliance on Russia for everything from reactor fuel rods to medical isotopes is a “strategic vulnerability” that is “unsustainable.”

A bipartisan bill now before Congress would ban imports of Russian nuclear fuel, bulk up U.S. uranium mining, and promote greater U.S. uranium processing capability.

Over the past several decades, Russia’s lowest-cost production of enriched uranium effectively killed the uranium enrichment industries in the EU and the U.S.

A megaproject would be required to supplant Russia. New uranium mines and processing plants would take about a decade to build.

It must be done, though, no matter the outcome of the war in Ukraine, says U.S. Sen. Jim Risch (R-Idaho), a co-sponsor of the bill to ban Russian uranium imports.

“It’s going to take generations before there’s any trust again in the Russians,” Risch says.

The Biden administration’s landmark Inflation Reduction Act (IRA) provides subsidies to kick-start a more robust U.S. nuclear fuel supply chain.

But the U.S. and the EU could accelerate their transition away from Russia by turning to Canada.

Indeed, a 2022 report by Columbia University energy researchers said that U.S. allies such as “Canada and Australia … could increase their uranium mining production, if necessary, to make up for any shortfall that might result from cutting off Russian uranium.”

Canada is the world’s fourth-largest uranium producer. And most of its uranium reserves are high-grade deposits. Canada is also one of the most active explorers for new reserves of uranium and other critical minerals.

The McArthur River and Cigar Lake mines in northern Saskatchewan, owned by Saskatoon-based Cameco Corp., are the largest and highest-grade uranium mines in the world, according to the World Uranium Association (WUA).

Thus, “Canada has a significant role in meeting future world demand,” the WUA says.

That may be. Cameco has recently signed uranium supply agreements with Bulgaria and with Ukraine, which relies on nuclear energy for about 55 per cent of its electric power generation.

And demand is growing, with scores of new and retrofitted extended-life nuclear-power reactors coming on-stream this decade in China, Europe, and the U.S.

Ontario plans to build as many as five new nuclear reactors to meet an expected near doubling of Ontario power demand in coming decades.

Canada has a staggering 694,000 metric tonnes of estimated recoverable uranium reserves, only a fraction of which it is tapping. Canada produced just 3,885 metric tonnes of uranium in 2020.

“We can become a reliable provider of these resources or products for our international allies,” Steven Guilbeault, the federal minister of environment and climate change, told reporters at the latest G7 summit. That summit was focused on needed increases in the supply of critical minerals.

But Canada’s reserves are geographically closer to major markets and are of the highest quality. And Canada’s supply chain infrastructure for civilian nuclear power, dating from the 1960s, is among the world’s largest and most sophisticated.

So far, critical minerals like copper, cobalt and lithium have been getting most of the attention in global ambitions for decarbonized economies.

But uranium, long outsourced to politically dubious suppliers, is beginning to have its moment.

Anyone can read Conversations, but to contribute, you should be a registered Torstar account holder. If you do not yet have a Torstar account, you can create one now (it is free).

Conversations are opinions of our readers and are subject to the Community Guidelines. Toronto Star does not endorse these opinions.