The Russian rouble tumbled past 89 against the dollar for the first time in more than 15 months on Friday, weighed down by domestic political risk concerns after an aborted armed mutiny over the weekend, and lacking any support drivers.

By 1156 GMT, the rouble was 1.8% weaker against the dollar at 89.15 after earlier hitting 89.3275, its weakest point since March 29, 2022.

It lost 1.8% to trade at 96.74 versus the euro , also a 15-month low. It shed 1.4% against the yuan to 12.23 <CNYRUBTOM=MCX>, a more than 14-month low.

“The rouble continues to crumble,” Alor Broker said in a note. “It lost another 1.4% in value yesterday, despite stabilising oil. The target for the dollar-rouble pair of 90 is approaching and is likely to be reached.”

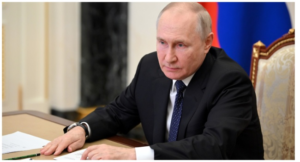

Capital controls have helped insulate the rouble against geopolitics in the 16 months since Russia invaded Ukraine, but mercenary leader Yevgeny Prigozhin’s aborted weekend march toward Moscow reverberated through markets and raised questions about President Vladimir Putin’s grip on power.

The rouble lost a key support factor on Wednesday as a month-end tax period that typically sees exporters convert foreign currency revenues to meet local liabilities passed.

Bank of Russia Deputy Governor Alexei Zabotkin said reduced export revenues and the balance of payments were determining the rouble’s weakening, which he said carried no risks to financial stability.

“But, certainly, the exchange rate dynamics will be taken into account at the next board meeting on the key rate in terms of clarifying the impact … on inflation dynamics this year,” the Interfax news agency quoted Zabotkin as saying on Friday.

Brent crude oil , a global benchmark for Russia’s main export, was up 0.1% at $74.41 a barrel.

Russian stock indexes were lower.

The dollar-denominated RTS index (.IRTS) was down 2.1% to 985.5 points. The rouble-based MOEX Russian index (.IMOEX) was 0.3% lower at 2,787.6 points.

Shares in Gazprom (GAZP.MM) dropped about 0.6% after the energy group’s shareholders approved the board’s recommendation against paying full-year 2022 dividends after allocating a half-year dividend of 1.2 trillion roubles ($13.6 billion).

($1 = 88.2200 roubles)