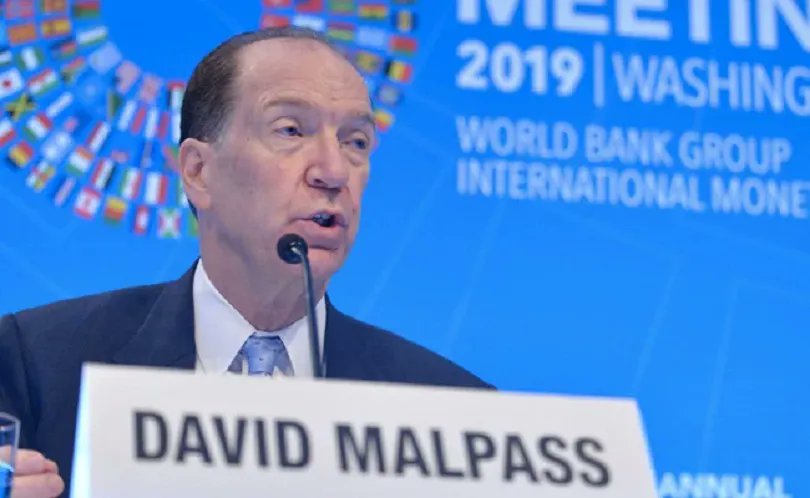

David Malpass, former president of the World Bank, has commended the administration of Bola Tinubu for scrapping petrol subsidy as well as unifying the exchange rate.

Commenting on a Financial Times report on Tuesday via his official Twitter handle, the astute economic analyst said the policies were important steps towards the reduction of corruption in the country.

“Glad to see President Bola Tinubu taking concrete steps to scrap Nigeria’s harmful government subsidies and multiple exchange rates,” Malpass tweeted.

“These are important steps toward currency stability, lower inflation, and reduced corruption in Africa’s most populous country.”

The Bretton Woods institution, an ardent supporter of petrol subsidy removal in Nigeria, had said the country’s fiscal and debt pressures would increase if the subsidy was scrapped in the present month.

In his inaugural speech on May 29, President Bola Tinubu declared that the petrol subsidy payments had stopped — a pronouncement that kickstarted post-subsidy realities immediately.

NNPC, after the presidential declaration, announced the adjustment of the pump price across its retail outlets nationwide.

Likewise, the president also said the country’s “monetary policy needs thorough house cleaning. The Central Bank must work towards a unified exchange rate”

Complying with the president’s directive, the Central Bank of Nigeria announced the unification of all segments of the forex exchange (FX) market, signalling the end of its control of the foreign exchange market and allowing rates to be decided by market forces.

TheCable had reported that the FX rates converged at the official and parallel markets on Tuesday as market participants continue to trade freely.